The global labeling industry depends heavily on robust, precise machinery to meet the packaging demands across sectors, from food and pharmaceuticals to electronics.

For years, China has led the way as the primary hub for labeling machine production, benefiting from its expansive manufacturing infrastructure, cost advantages, and innovation-driven approach. However, with recent challenges and global shifts, it’s worth exploring if China can maintain its status as the world’s most important base for labeling machines.

Yes, China continues to hold a leading position in labeling machine production, but growing challenges make innovation and adaptation essential to maintain this dominance.

The Historical and Current Landscape of China’s Labeling Machine Industry

Historical Growth

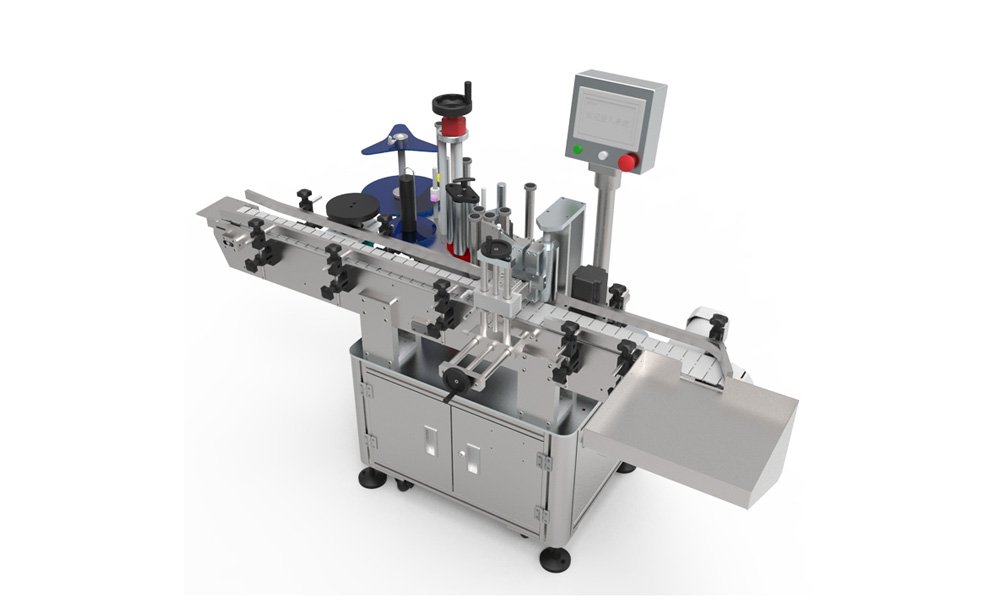

China’s labeling machine industry began its journey as a low-cost manufacturing base, primarily producing bottle labeling machines and other basic packaging equipment. Over time, local manufacturers gained expertise and adopted advanced technologies, allowing China to expand its offerings beyond entry-level equipment. The industry soon evolved to supply mid-range and high-tech labeling solutions to global clients, enhancing its reputation in the global market.

In recent years, Chinese manufacturers have established themselves as reliable suppliers of a wide range of machinery. This includes more specialized models like customized labeling machines and vacuum packaging machines. Such advancements, along with a focus on reliability and precision, have enabled Chinese producers to capture significant global market share.

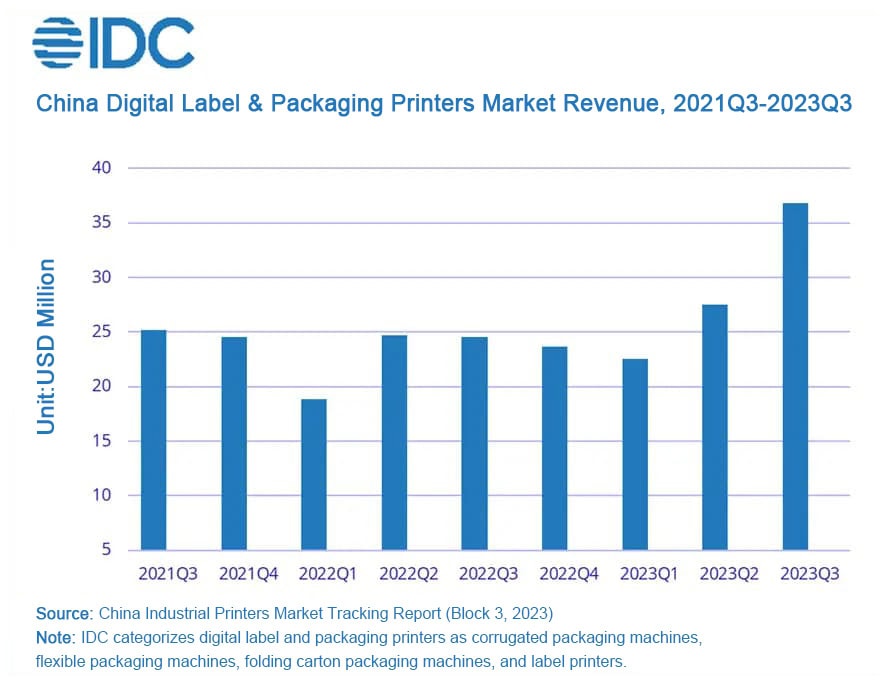

Market Size and Growth

China’s labeling machine industry is sizable and growing. By 2022, the country’s labeling market was valued at approximately 59 billion RMB (USD 8.7 billion), demonstrating steady demand in both domestic and international markets. Despite the COVID-19 pandemic, demand for labeling machines continued, driven by the rapid growth of e-commerce, pharmaceuticals, and personalized products. With growth rates projected to remain positive, China’s labeling machine industry remains a cornerstone in Asia-Pacific’s packaging sector.

Advantages of Labeling Machine Production in China

Cost and Labor Advantages

One of China’s primary advantages in maintaining its leadership is the cost-effectiveness of production. Lower labor costs allow for competitive pricing on industrial label printers and other high-precision machines. This factor is particularly advantageous for companies that need to source high-quality machinery at a reasonable price.

Robust Supply Chain

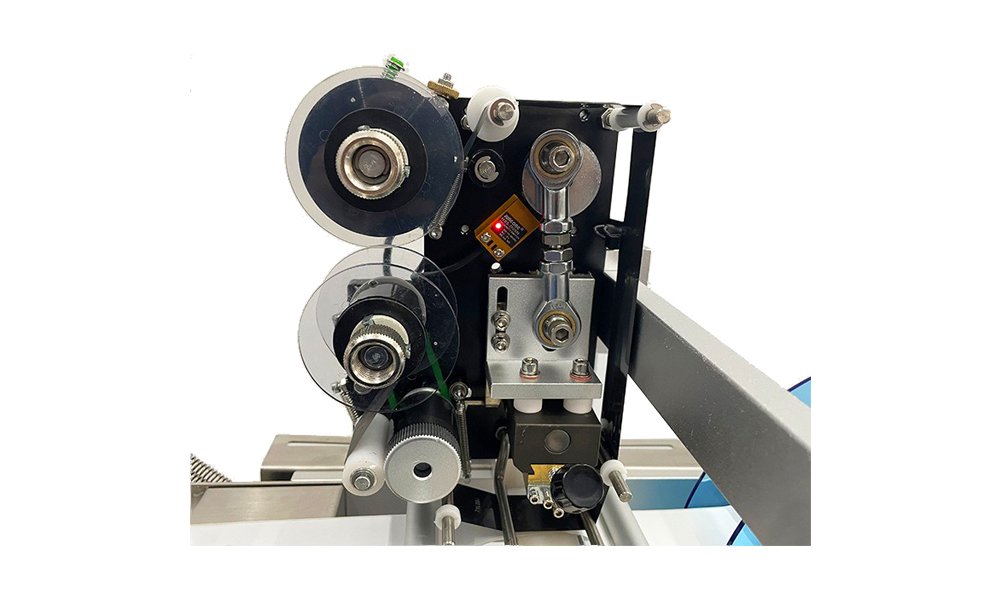

China’s extensive and well-integrated supply chain supports efficient manufacturing. Key components, such as sensors, motors, and advanced software systems, are readily available from local suppliers, reducing costs and production time. This robust network enables Chinese manufacturers to provide competitive lead times and rapid deliveries, allowing them to meet the demands of global clients seeking reliable labeling machinery.

R&D and Technological Investment

China’s investment in technology is another driving force in the industry. With initiatives like Industry 4.0, which focuses on digitization, automation, and smart technology, Chinese manufacturers are keeping pace with global innovations. These advancements are visible in cutting-edge equipment, such as flat labeling machines, which integrate precision sensors and programmable logic controllers for enhanced accuracy. This investment in R&D positions China’s labeling machine industry for long-term success in both domestic and international markets.

Challenges Facing China’s Labeling Machine Industry

Environmental Regulations and Rising Costs

While China’s labeling machine industry has experienced robust growth, it also faces significant challenges. Environmental regulations have tightened, pushing companies to adopt sustainable practices that can be costly. For example, rising energy and material costs impact the pricing of various machines, including powder filling machines and automated systems for large-scale labeling. These cost pressures make it difficult for some smaller manufacturers to compete on price alone, particularly in a global market with shifting demands.

Global Market Competition

China’s labeling industry faces strong competition from high-tech markets in Germany, Japan, and the United States. These regions produce advanced labeling and packaging solutions that are attractive to clients seeking premium options. As a result, Chinese manufacturers are compelled to innovate continually and improve quality to remain competitive in higher-end markets. Without consistent technological upgrades, maintaining a foothold in these sectors will be challenging for Chinese producers.

Shifting Market Demands

The market demand for labeling solutions has evolved, especially with the growth of e-commerce and personalized packaging. Products now require intricate labels, short production runs, and rapid delivery times. In response, China’s labeling industry is incorporating digital printing, automated controls, and other advanced technologies to meet these needs. However, the shift requires significant capital and technological investment, which can strain smaller companies.

Strategies Employed by Chinese Labeling Machine Companies

Technological Upgrades

Chinese manufacturers have adopted digital printing and other smart technologies to meet diverse industry needs. The demand for versatile machines, such as those that support both traditional and digital label printing, has driven many companies to integrate more advanced features. For example, flag labeling machines and other multi-functional equipment are now commonly equipped with intelligent control systems, allowing businesses to adapt to different labeling specifications quickly and efficiently.

International Expansion

Many Chinese companies are expanding their reach through the Belt and Road Initiative, strengthening their presence in emerging markets in Southeast Asia, Africa, and Eastern Europe. By establishing distribution networks and service centers in these regions, Chinese labeling machine companies can maintain a competitive edge globally and continue driving export growth.

Growth of Smart Labels and RFID

With advancements in RFID and other smart labeling technologies, Chinese manufacturers are exploring new areas of growth. RFID technology, in particular, is experiencing a surge in demand, as it enables high-speed, contactless tracking for logistics and retail applications. By investing in RFID-compatible systems, Chinese producers can cater to sectors like logistics, apparel, and even food safety, where tracking capabilities are critical.

Conclusion

China remains a pivotal player in the global labeling machine industry, combining cost-effectiveness, a comprehensive supply chain, and technological advancements. However, challenges such as rising costs, environmental regulations, and global competition are pushing the industry toward innovation. If Chinese manufacturers can continue to leverage technology and expand internationally, China will likely retain its title as the world’s most important labeling machine production base for the foreseeable future.